Entrepreneurs

Information for companies applying for the first time

New Company Applicants, please consider the following information before submitting an application.

Welcome to the online application form for first-time applicant companies wishing to present their investment opportunity to K2X.

This is the first stage of K2X’s review process of investment opportunities. Upon successful completion of the Screening Stage, you will be invited to complete the second part of the application process.

K2X will provide notifications when the Screening Application has been received and after the Screening Stage is completed.

Deal Types

- Technology: K2X welcomes applications from high potential Early-Stage companies in all sectors of Life Sciences and Technology (except: crypto currency and real estate)

- Stage: Early-Stage companies (Seed and Series A) but will consider later stage deals subject to the opportunity

- Raise Instruments (preferred): Convertible Notes and Equity (Preferred Shares)

- Nationality: Agnostic to company nationality if it is legally registered and fully compliant with all laws of the home country or to a global third-party jurisdiction (i.e. USA, United Kingdom)

- Deal Sources / Referrals:

- Recognized Angel Groups, Early-Stage Investment Syndicates, VC’s, Family Offices

- K2X Investors/Advisors or recognized professional investment K2X allies

- Direct company applicants meeting K2X’s base criteria via k2x.capital

- No third-party deals (agents/brokers): K2X engages directly with presenting companies

- Corporate Structure: C corp or similar structure for ex-US companies

Requirements

- Lead Investor: K2X is NOT a lead investor and follows the Term Sheet of a recognized lead investor

- Pitch Deck: Current version with clear and concise information featuring technology/market highlights, deal stage, ask/terms and closing date

- Term Sheet: Issued by the lead investor of the round/raise being considered

- Due Diligence: Issued by the lead investor or a recognized independent third party

- On-Site visit: Company site visit is required prior to confirming an investment by K2X Manager(s) and/or KAB Advisor(s)

- Currency: Deal values should be US Dollars in presentations (written and oral). Actual transaction of a deal with K2X is preferred in US Dollars but another globally recognized currency may be considered

Process

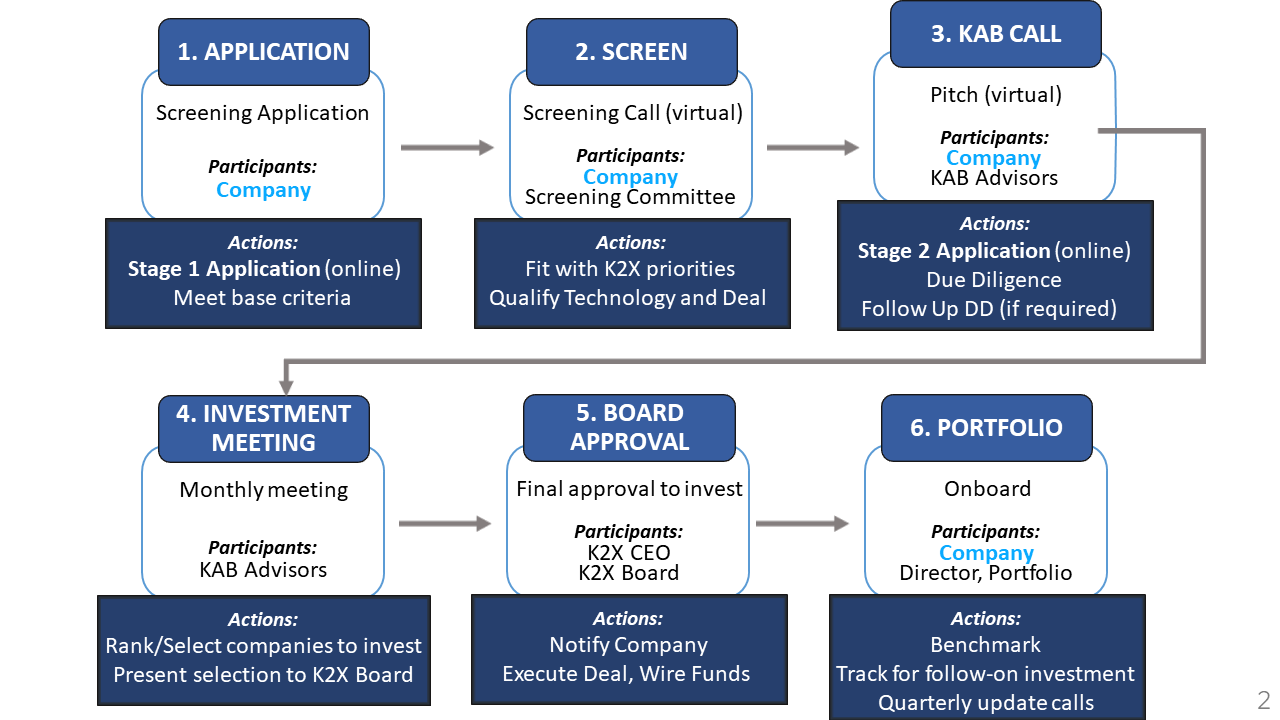

- Follows a specific protocol in the Screening and Due Diligence of companies for all investments. (see below: Table A)

- Involves K2X Management and K2X Advisory Board (KAB) members

- Deal review turnaround for an investment decision (average and not absolute): 90 day

Information Sharing

- K2X uses the Dealum deal management platform. After successfully clearing the Screening stage and you are invited to advance to the next stage, KAB Call, you will be invited to complete or share an existing Dealum profile

- Company data is only accessible to K2X Management and K2X Advisory Board (KAB) Advisors

- K2X does NOT sign Non-Disclosure Agreements (NDA) for any part of the Screening and KAB Call stages

NOTE: Company participation in K2X’s deal review process does not constitute any obligation by K2X to invest in the applicant company.

Table A: K2X Deal Flow Process Overview